How to Avoid Errors in Your Assignments with Trial Balance?

As an accounting student, you will probably come across the trial balance multiple times in your coursework. Whether you are tackling assignments or preparing for exams, understanding how to use the trial balance correctly is the crucial point. Mistakes in your trial balance can lead to significant issues in your financial statements, and these errors often spill over into your overall grades.

If you want to seek guidance in your accounting subject, you can seek an assignment writing service UK. There are experts who help you to generate high-quality documents for your academics. In this article, you will learn how you can avoid errors in your assignments with a trial balance so that you can achieve better accuracy in your work.

What is a Trial Balance in Accounting?

A trial balance is a list of all the accounts in your ledger which are either debits or credits. It is used to check that the total of your debits equals the total of your credits. If they match, it means your books are balanced. If you are a student this is one of the first checks to make sure that everything is correct before you start building more detailed financial statements like the income statement or balance sheet. But if your debits do not match your credits, then it means that something is wrong in your calculations.

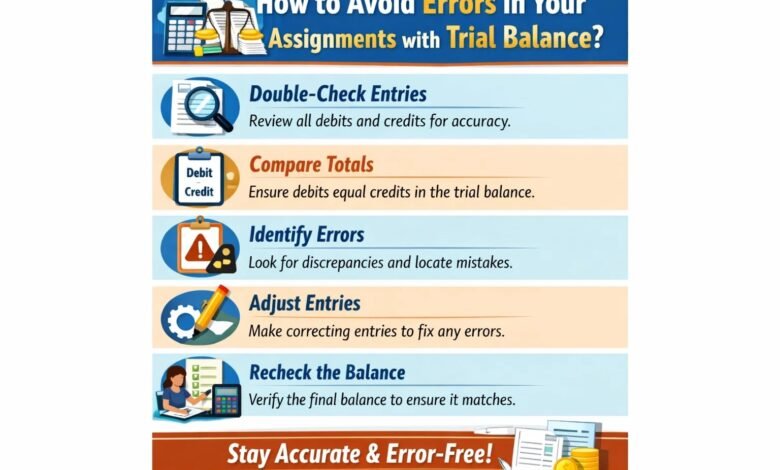

8+ Ways to Avoid Errors with the Help of a Trial Balance

When it comes to accounting assignments, errors in the trial balance can cause headaches, confusion and even lower grades. But with a help trial balance, you can quickly identify common errors in your document. If you want to seek help for any specific topic you can seek help from Assignment Desk. Their expert writers help you guide every concept clearly. Below there are some standard methods that you can use trial balance:-

Double-Check Entries

Mistakes happen to everyone, but catching those mistakes is very simple by checking your entries twice. Make sure that the numbers which you have entered into your trial balance are the same as those in your journals or ledgers. One example would be if you entered a debit, but you instead entered it as a credit. Just take a quick minute to review all of your entries again because minor misprints can lead to a lot of unnecessary stress down the road.

Verify Totals

After entering everything into your trial balance, it’s time to add together your total debits and credits. If the two totals do not match, that’s an indication that there is an error somewhere in the numbers. The most common cause of the error is just a small mistake – perhaps you missed an entry, or you switched two numbers around accidentally. It is better to find the error now than to discover it after you finish putting together all of your statistics assignment help.

Review Debits

In accounting, the Debit side has typically been associated with Accounts having assets and/or expenses. Newer accounting students may make mistakes when they record an account in a Debit, when they meant to record it in a Credit, because they are learning how to associate debits and credits together. To avoid making these errors, take a moment and review the accounts you included on the Debit side of your trial balance. This will help you identify how and where each account fits.

Check Credits

Credit accounts are typically associated with liabilities or income. In order to avoid confusion, it is vital that you have a clear understanding of which accounts are being credited. If you have just started learning about accounting, you may experience confusion about debits and credits. A quick reference for remembering this is that revenue accounts (like sales) and liability accounts (like loans) are usually credited. Once you have memorised this, you will find it much easier to avoid making trial balance errors.

Ensure Consistency

When creating your project, use a consistent format when recording every entry. Working with either a software program or manually writing down on paper, use a fixed structure throughout. Using a consistent format will help keep your project organised and prevent mistakes. Using various methods/tools to create records may cause confusion. Therefore, keep your records consistent and straightforward regardless of the tools used; using Microsoft Excel and/or handwritten notes should be a familiar and convenient process.

Use Software

If your company allows the use of software for accounting purposes, you should take advantage of the tools available to you (i.e. QuickBooks, Xero or Microsoft Excel). These software applications are designed to automatically calculate debits and credits for you. By using these applications, you eliminate some of the manual entry errors involved in balancing your accounts. Also, using accounting software will allow you to complete all of your accounting fairly quickly, so you can focus more of your time on analysing the financial results of the period.

Apply Adjustments

When completing your initial trial balance, you may discover that there are items that need adjustment. For example, a company may have prepaid expenses when the initial trial balance was posted. During the accounting period prior to the date of the final trial balance, there may also be revenues that were accrued. In both cases, the adjustment made to the initial trial balance provides the company with a clearer understanding of its financial position.

Follow Format

As you work on your assignment, it’s crucial to stay organised with your format. The more organised and clean your work is, the less likely you are to have errors. A clean format also makes it easier for you to submit your work and for your instructor to grade it. By using a clean format, you’ll likely not forget something important. If your instructor has given you a specific format to follow, be sure to do so, which will keep you focused and reduce any confusion while you are entering your numbers.

Reconcile Accounts

There may be times when everything does not seem to be correct; this is normal. You will need to perform a reconciliation of your accounts. This means that you’ll need to return to your ledger or journal and re-check the entries to ensure all of your entries are correct. Performing a reconciliation can take time, but it is essential to your trial balance; no matter how small or large the error is, a reconciliation is the best way to identify and correct any problems.

So, these are some of the ways that you can use to avoid errors using a trial balance. If you can seek any help from experts, you can ask them, “Can you help me to do my assignment for me?” They will provide you with all the crucial materials.

Final Thoughts

Using the trial balance as your first checkpoint is one of the most innovative ways to catch errors before they mess up your entire assignments. It is a simple tool for the students that can make a massive difference in helping them to stay organised in their accounting work. By following these steps and taking your time to double-check your entries, you can reduce the chances of errors in your assignments. If you need any further guidance related to this, then you can seek an assignment writing service UK. These services provide you with expert guidance related to every subject that you are struggling with.